Review for Four Horsemen

Introduction

The economy is busted! That's easy to say now, as we are in the middle of a double dip recession apparently (until the government spins their way out of it), the banking sector is buggered, unemployment soaring... The thing is that the economy has always been busted, even when it's been working as it's meant to. And in recent years it has been more busted than usual.

My first inkling that the system was screwed was when I watched the movie Trading Places. This movie was made in the early eighties, when the economy still worked in the old way, pre-deregulation, so it isn't exactly relevant. You have to ignore the insider trading which was illegal even then, and that several countries have since placed a ban on the short-selling which serves as the climax to the film. Basically two guys, with hardly a penny to their name, go to Wall Street, and sell commodities, in this case oranges. They don't actually own any of these commodities; they just sell them, and make a load of money. So now they have lots of money, and the obligation to fulfil delivery of oranges at the end of the day. They wait, and wait, until the price of oranges drops. They then buy back the oranges they have sold, at a much lower price, and wind up with a wodge load of profit, and no more obligations. Forget the insanity, that they never actually see an orange, that the whole process of buying and selling is over in minutes, and utterly divorced from the farmer growing the stuff for years, finding a buyer, shipping them to market, and the oranges eventually winding up in our fruit bowls. Forget the fact that the decisions made in Wall Street can mean the difference between solvency and bankruptcy for a farmer thousands of miles away. My question is, where did that profit come from? Did that money magically appear? If you want to know the answer, you need this documentary.

But Trading Places was just a movie you say. It wasn't real. It's just fantasy. So here's some reality for you. There are a couple of institutions called Standard & Poor's, and Moody's. You might have heard of them if you watch the news. These two institutions have unprecedented power. They are credit ratings agencies, and can downgrade the rating of whole nations, including the biggest economy in the world, the US. Nations now have credit ratings just as people do, and that determines the interest rate at which countries can borrow money at. The interest on a country's debt goes up, and that affects the entire population, as their services get slashed to service that debt. Take a look at Greece, or Spain right now, and see what these decisions mean to their people. We Westerners live in a democracy, right? Wrong! Unless you can tell me that you have a say in how Standard & Poor's and Moody's work. These companies have a significant power over all our lives, and are any of us on their board of directors, do we have a say on how they are run, or does anyone even know where their offices are? Do you want to know how much power financial institutions actually have over our governments? Then you need this documentary.

One final thought. Let's say I own my own home, a nice terraced house in suburban London which is worth a whopping great quarter of a million pounds, a figure that I would have thought impossible when I was a child. I'm rich, right? But I want to live in a nice semi-detached instead, so I start looking around. They cost more than a quarter of a million pounds if I want to stay close to my neighbourhood and my friends. It turns out that I can't afford to move. So despite this quarter million pound asset, I'm actually poor. How does that work? What is this house really worth? The answer is in this documentary as well.

The Four Horsemen feature documentary tells us that the economy is even more busted than I believed. It tells us that the way things are going now, the end of the world is nigh. Because of our unbridled greed, and a complete divorcement between the economy and the actual state of the world, that War, Conquest, Famine, and Death are riding inexorably in our direction, and the only way to avert them is to rebuild our financial systems from the ground up. This film gathers interviews with 23 global thinkers, and sets about explaining how the global economy really works. It's not a film that looks for scapegoats, conspiracies or villains. At its heart, it's about examining the structure of the financial institutions that now run the planet, finding out where they have failed, and offering solutions that will put the global economy back on track. Topics covered include Empires, Banking, Terrorism, Resources, and Progress.

The Disc

The film gets a 1.78:1 anamorphic transfer on this disc which is fine for the material. It's mostly talking heads interviews, interlaced with stock footage, and animation specifically created for this documentary. The contemporary footage is fine, while the stock footage varies according to its vintage. The audio is DD 2.0 English of course; the dialogue is clear throughout, and never overpowered by the music. The only thing missing is a subtitle track.

Oddly enough the copyright warning informs that this disc isn't to be rented from Lovefilm, Blockbuster, or Netflix, before leading us to the animated menus. Extras include the two official trailers for the film. The Making of Four Horsemen lasts 23 minutes, and is pretty self-explanatory, although it also includes the original ending to the film, which is worth watching. The Billion Dollar Bill Animation lasts 3 minutes and is a comic intermission which was deemed not to match the tone of the material, and was subsequently cut. The extras finish off with a couple of comedy talking head pieces, with Scott Carver - The World's Best Banker, and The Washed Up World Bank Banker coming in at 2 and 14 minutes respectively.

Conclusion

Of all the lies that governments have told their populations, the most insidious is that we mere mortals are too ignorant, too ill-educated to understand economics, that we need degrees from top universities, and career experience in venerable institutions to even offer an opinion. It's this lie that lets them tax us from birth to death, and control every aspect of our lives because 'they simply know better'. And we let them do it. We're complicit in our own slavery, especially if what this documentary has to say is accurate. For the various commentators in this 100-minute feature manage to take the complex and jargon laden concepts, and reduce them to simple, clear, and concise language, without losing the essential details. At the end of this documentary, even I could understand how the world works, or as in recent years, fails to work, and it makes for chilling viewing.

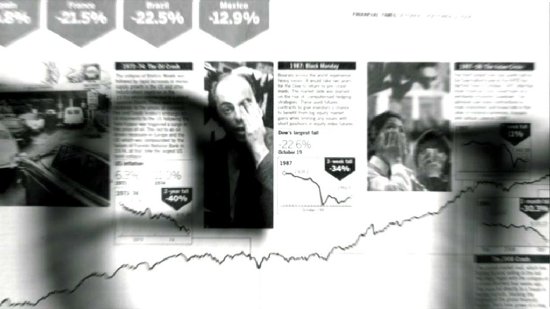

I hope I'm not giving too much away, but it boils down to the difference between Classical, and Neo-Classical Economics. For most of the twentieth century, the Western world followed the Classical model. This was when money was tied to commodities, silver or gold and the economy ran on assets, other commodities, and resources. A country's wealth was determined by what it owned, and what it created, and what it sold. Then along came Reagan and Thatcher, and a new wave of economists, who switched the world over to the Neo-Classical model. This divorced money from commodity. Money now operates by something called fiat, Latin for 'let there be', and nations create money willy-nilly, as required, or as in the case of Zimbabwe, something to keep the printers and graphic designers busy. This is all essentially 'worthless' money, or rather it is worth what the institutions say it is. It's all borrowed against nothing. It comes from nothing, leaving a hole behind which is termed as debt, and that debt trickles down to the lowest rungs of society to be serviced, by the increase of prices of basic goods. I'm sure we're all familiar with quantitative easing. I was shocked to learn that this is how the economy now operates in general, with banks so big that they hold countries like the US to ransom.

There's a lot more here besides, and it's fascinating viewing to see how foreign aid, ostensibly an altruistic act on the part of developed nations, actually fosters terrorism. There's also a look at how our consumerist society is increasingly out of control in a world where resources are being rapidly depleted, with no contingency for their loss. We're still operating in a capitalist paradigm that assumes that growth will be eternal and infinite, made worse by the separation of money from assets. Where the economy used to be the organ in the world body that regulated trade, it's now become a cancer eating up that body from the inside.

This is where we come to the cure, and the solution that many of the speakers have to offer. There are a few aspects of this documentary that I had issues with, and found difficult to agree with. The analysis of Empires, the state of decadence and the symptoms that signify a civilisation's decline seemed simplistic, although as an introduction to the main feature it does serve to add drama. At the other end the solutions offered had me scratching my head. To summarise, they suggest regressing the world's economy to the earlier, Classical model. It makes sense on the surface, common sense, where a day's work is worth a day's pay, where money is actually representative of assets held by the nation, where wealth is measured in resources and production, not debt. But there's a contradiction in tying money's value to a limited resource as mentioned earlier in the documentary, and then opining that the resource is actually unlimited, which it clearly isn't. Also, there has to be a reason why we left the Classical model behind, and that is never made clear in the documentary. What did Reagan, Thatcher, and the economists of the era actually believe was wrong with it? And how would a system, that was ideal for a world of 3 billion, with at the time what seemed like limitless resources, work for a population of more than twice that, and with dwindling resources?

Well, this turned more into an opinion than a review, but it's hard to talk about the economy and the state of the world absolutely objectively. What I can say is this. If you want to know what is wrong with the global economy, then this documentary is an essential resource. It offers its material in an accessible and understandable form, without over-simplifying it. If you want to know how to fix the economy, then I'm less certain of how useful the ideas presented here will be. But whatever they are, anything has to be better than then misbegotten mess that we live with today!

Your Opinions and Comments

Be the first to post a comment!